mobile al vehicle sales tax

The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100.

Simplified View To The Maze Of India S Ev Charging Standards E Mobility Simplified Basics Of Electric Vehicles An Ev Charging Ev Charging Stations Charging

Alabama does have local sales tax rates as well so check which sales tax rate you should be using with the TaxJar sales tax calculator.

. Revenue Forms and Applications. What is the sales tax rate in Mobile Alabama. With local taxes the total sales tax rate is between 5000 and 11500.

State of Alabama Sales Use Tax Information. According to the Alabama Department of Revenue Alabama charges 2 for auto sales tax. The actual sales tax may vary depending on the location as some countiescities charge additional local taxes.

Select the Alabama city from the list of cities starting with A below to see its current sales tax rate. The state sales tax rate in Alabama is 4000. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

Mobile AL 36652-3065 Office. Look up 2022 sales tax rates for Mobile County Alabama. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing businessesprofessions doing business within the Mobile License Tax Jurisdiction.

Alabama Legislative Act 2010-268. The minimum combined 2022 sales tax rate for Mobile Alabama is. 24 rows rental tax.

Alabama has recent rate changes Thu Jul 01 2021. Posted January 18 2021 January 18 2021. The department collects all ad valorem taxes in Dougherty County the City of Albany the Board of Education and the State of Georgia.

All persons or businesses that sell tangible personal property at retail must collect tax and make payments to the City. Sales Tax is imposed on the retail sale of tangible personal property in Huntsville. One of a suite of free online calculators provided by the team at iCalculator.

Monday Tuesday Thursday Friday. Code of Alabama Section 40-23-24. Compared to other states Alabamas state auto sales tax rate is modest at 2 percent of the purchase price.

In some parts of Alabama you may pay up to 4 in car sales tax with local taxes. The one with the highest sales tax rate is 36509 and the one with the lowest sales tax rate is 36512. 4 rows Mobile AL Sales Tax Rate.

The state sales tax rate in Alabama is 4. We also processes the monthly Mobile County SalesUseLease Tax. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile.

A breakdown of local tax rates can be found on the Sales Tax Rates publication from the Alabama Department of Revenue. Additionally local county taxes can be applied as well up to about 4 percent depending upon the county. The most populous zip code in Mobile County Alabama is 36695.

Please refer to each of the following cities INSIDE Mobile County. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal Staff may visit your property to review or update property information. In addition to light duty vehicles an automotive vehicle also includes a truck truck trailer or house trailer.

The Mobile County Alabama Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Mobile County Alabama in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Mobile County Alabama. This is the total of state county and city sales tax rates. 2 is the statewide sales tax.

As far as other cities towns and locations go the place with the highest sales tax rate is Bayou La Batre and the place with the lowest sales tax rate is Bucks. Sales tax is collected by the seller from their customer and remitted directly to the City of Huntsville. Section 34-22 Provisions of state sales tax statutes applicable to article states.

1100 Pinemont Dr Mobile AL 36609 235000 MLS 11457408 Centrally located custom built single family home with a two car garage for sale. If you are not based in Alabama but have sales tax nexus in Alabama you. The current total local sales tax rate in Mobile AL is.

The County sales tax rate is. Alabama Sales Tax Calculator ft. The Alabama sales tax rate is currently.

For Tax Rate at a Specific Address click here. Tax rates provided by Avalara are updated monthly. Sales Tax The state sales tax on automotive vehicles is 2 percent of the gross proceeds of the sale.

See how we can help improve your.

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Static Skynetblogs Be Media 98449 2071108885 Jpg Antique Cars Car Spyder

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

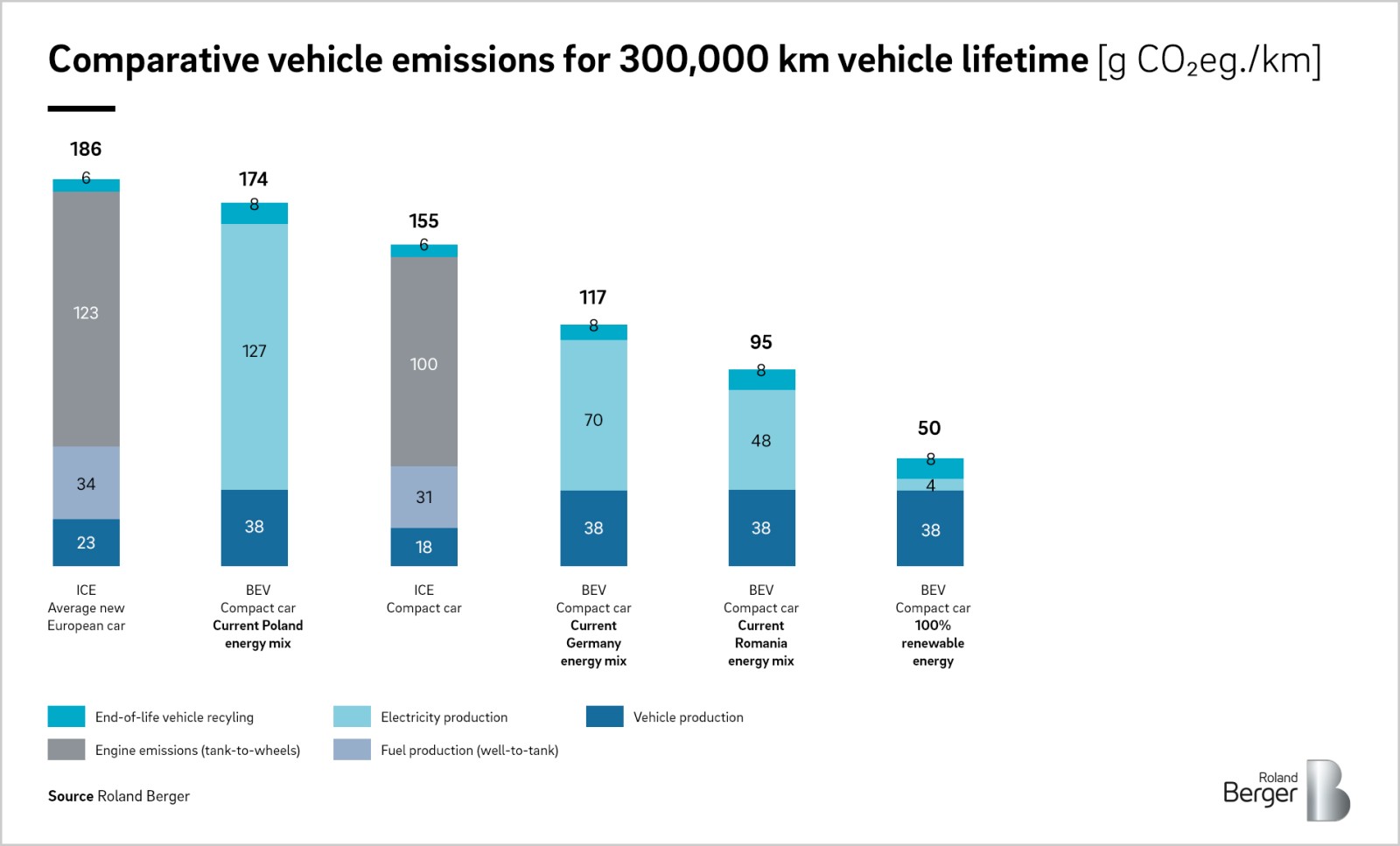

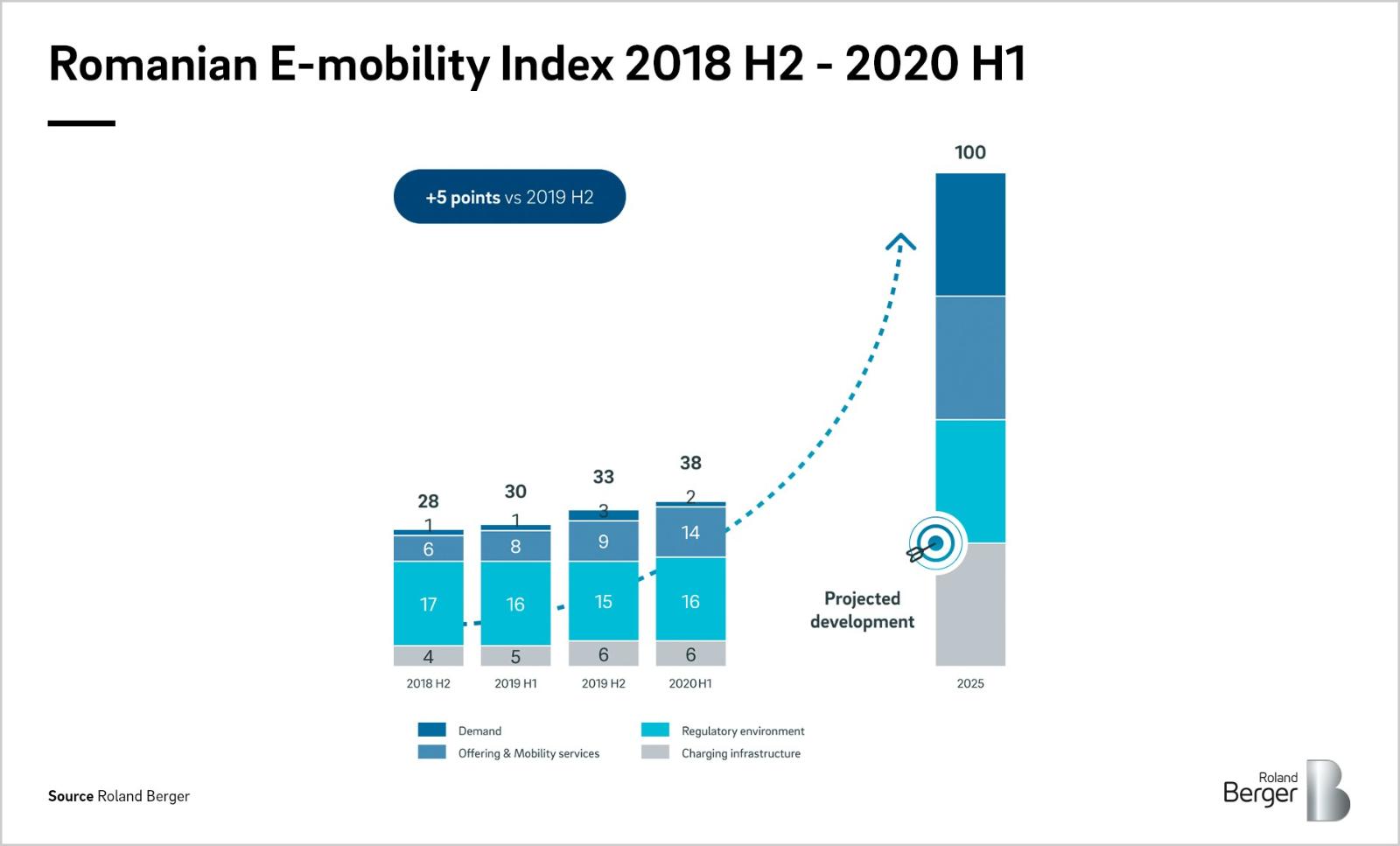

Romanian E Mobility Index Electric Vehicle Sales Plunge Roland Berger

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Local Delivery With A Minimum Purchase Of 1 799 Come By Our Daphne And Mobile Showrooms Today Alittleextra Freedeliver Delivery Daphne Calm Artwork

Electric Vehicles Guide To Chinese Climate Policy

Vehicle Flyer Card Holders Monavie Avon Mary Kay Rep Card Box Holder Card Box Card Holder

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

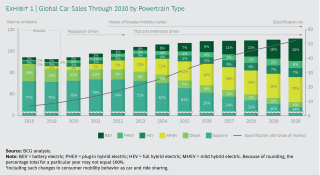

Who Will Drive Electric Cars To The Tipping Point Bcg

Pin On Electric Vehicle News Articles More

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Pin By George Panagopoulos On Cars Lamborghini Countach Lamborghini Classic Cars

Florida Vehicle Sales Tax Fees Calculator

Electric Vehicles Guide To Chinese Climate Policy

Romanian E Mobility Index Electric Vehicle Sales Plunge Roland Berger