tax service fee fha

Home inspection fees up to. How Does a Tax Service Fee Work.

Cheap Discount Mortgages Brokers Are Better In 2022 Mortgage Mortgage Banker Settling For Less

Create the tax forms.

. What is a tax service fee FHA. Document preparation by a third party Property survey. What is a tax service fee FHA.

A tax service fee based on the prior year with added adjustments for any changes. A set tax service fee for individual forms or schedules. A reader got in touch with us recently to ask a question about the allowable fees and expenses associated with FHA.

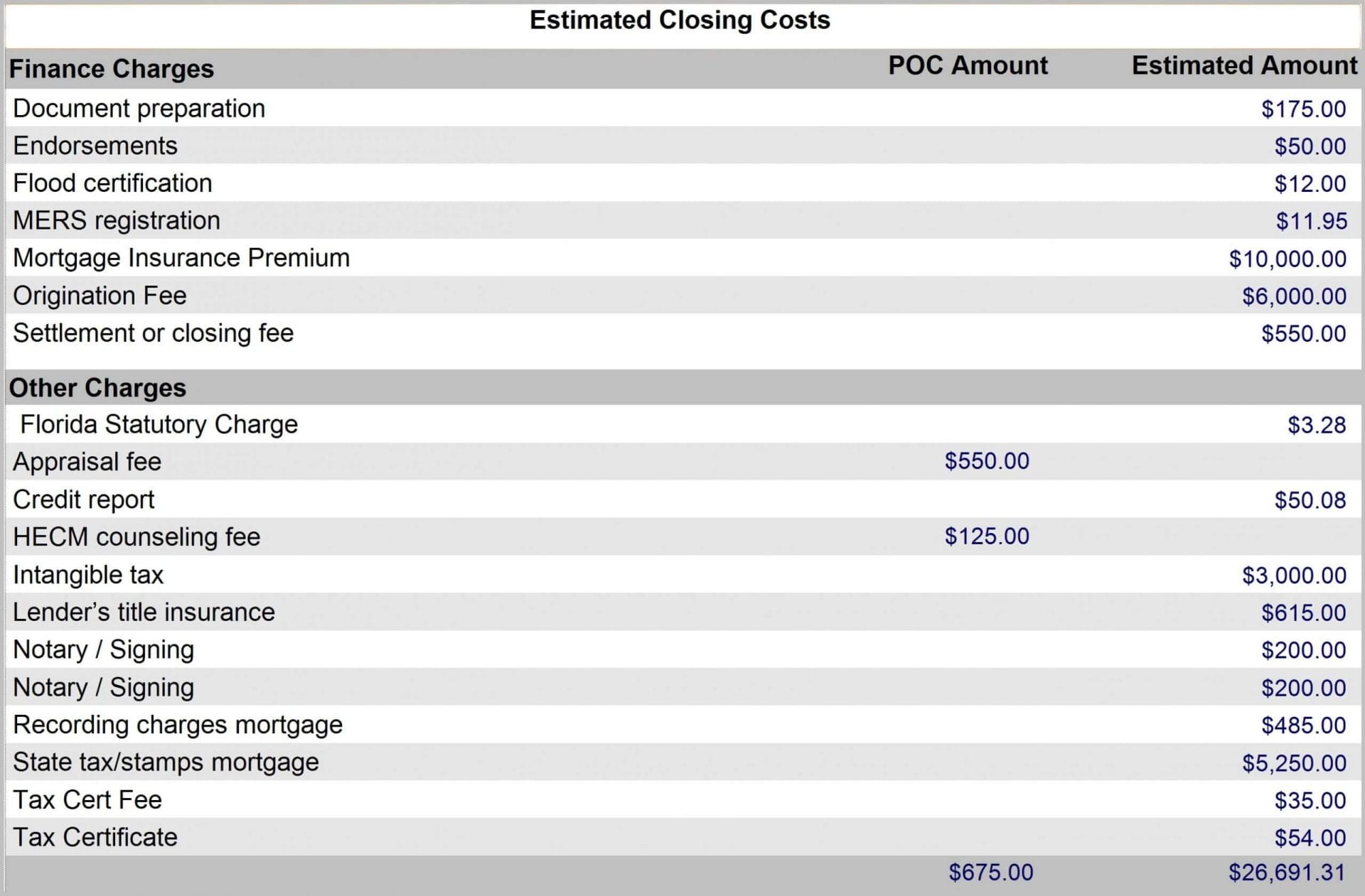

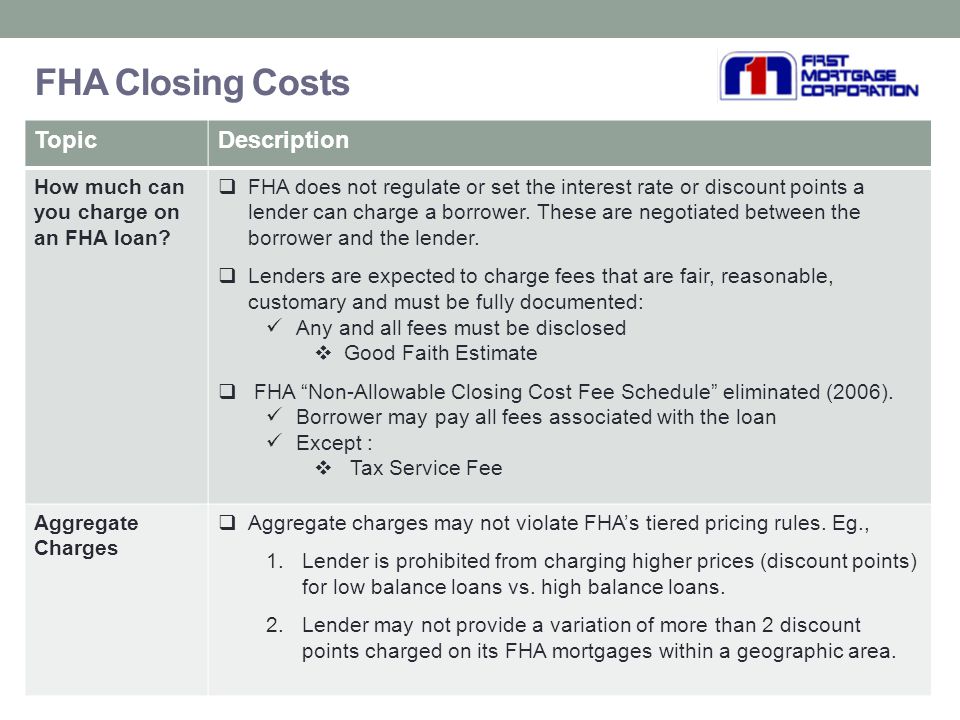

At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. Tax Service Contract Underwriting Fee Administration Fee Photo Inspection Fee Recording Fee - Balance above 1700 Termite Fees or Work Charges Any Messenger Fee incl.

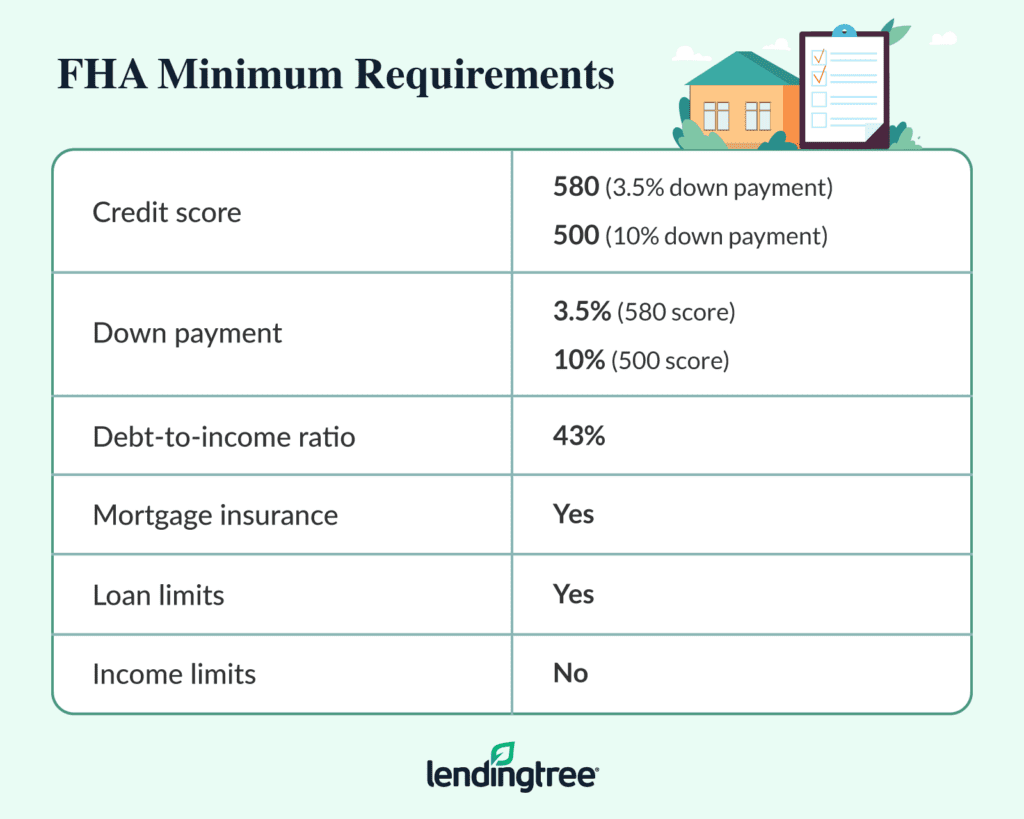

A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. The actions of the tax service. For loans through the end of 2009 the origination fee was limited to one percent.

Tax service fees are closing costs that are assessed as a means of making sure that mortgage holders pay property taxes in a timely manner. As part of the US. FL HFA PREFERRED PROGRAM FEES 85 Tax Service Fee deducted by US Bank at time of loan purchase 225 Compliance Fee payable to eHousing 200 Funding Fee deducted by US.

Review what you have uploaded. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. This OPTIONAL fee goes to a tax service company to keep track of your tax payments.

Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been. The tax service fee is typically paid by the buyer to the lender at the time the home is purchased. FHA Loan Questions.

A tax service fee directly benefits the loan servicing company or the. Credit reports actual costs Transfer stamps recording fees and taxes. The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the.

A minimum tax service fee plus any. Tax service fee 50. Tax Service Fee Ð 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been paid to date or if they.

Pay any taxes or fees by eCheck and. Simply put a tax service fee is paid to the company that services the loan. Most homeowners will NOT pay this fee because their property.

Tax Service Fee 50 This fee is paid to. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. Scan document into PDF.

Test and certification fees. Create a cover page. What is a tax service fee FHA.

Managing Fha Loans In Point Correctly Processing Fha Loans Emphasizing The Mcaw Presented By Calyx Online Training Stephen Breden September Ppt Download

Anthem Tax Services Tax Relief Review Lendedu

How To Improve Tax Prep For Working Americans

Consolidated Financial Management Tax Services Home Facebook

Fha Closing Costs For 2021 Nerdwallet

How To Reduce Closing Costs Smartasset Com

Reverse Mortgage Closing Costs Fees Explained

First Mortgage Corporation Ppt Download

Ata 23 Buyer Seller Cost Net Sheets W Raquel Ahlvers 1 28 21 Youtube

Fha Loan Income Requirements Complete Guide

Homes For Sale Real Estate Listings In Usa Real Estate Tips Buying First Home Selling Real Estate

Tax Service Fees For Va Fha Loans Hud Handbook

What Costs Does The Seller Pay For An Fha Loan

What Is A Tax Service Fee With Picture

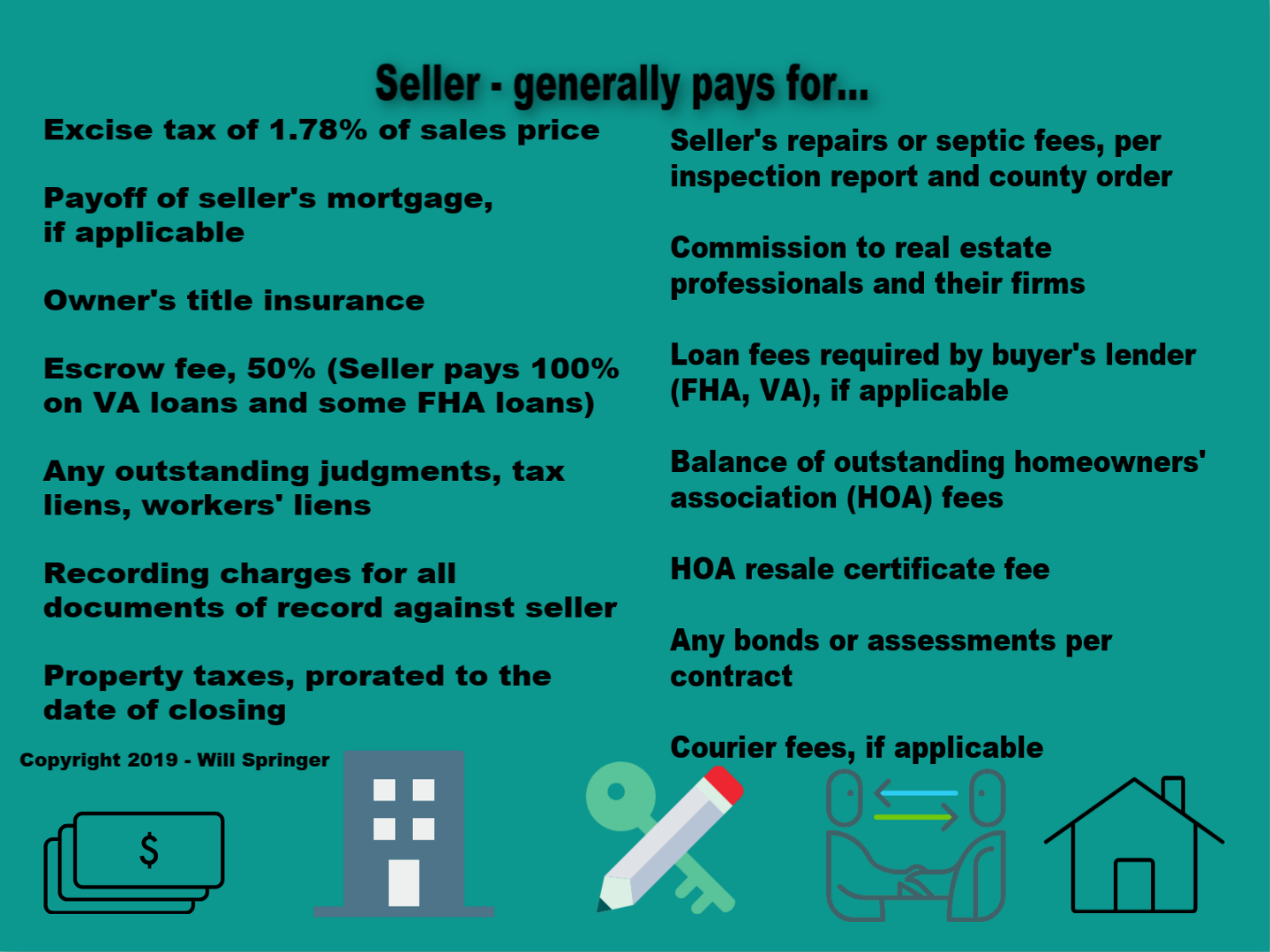

Working With Escrow The Settlement Statement Will Springer

Fha Loan Down Payment Rules You Should Know Credit Karma