charitable gift annuity administration

The American Council on Gift Annuities approved new gift annuity rates that became effective July 1 2003. Charitable Gift Annuity Program The University at Albany Foundation offers a charitable gift annuity program for donors interested in life income arrangements and for SUNY colleges and.

Charitable Gift Annuities Uses Selling Regulations

In exchange for this generous gift the donor will.

. The assets of the other gift arrangements. Give Gain With CMC. Previously she was with Charitable Trust Administration Company where she spent over 10 years assisting non-profits with the management and administration of their charitable programs.

Send a cover letter there is no formal application form along with the materials requested. 2022 and voted to increase the rate of. Find a Dedicated Financial Advisor Now.

The annuity can be funded. Toapply for a special permit to issue charitable gift annuities. 125 rows Annual expenses for investment and administration are assumed to be 10 of the fair market value of gift annuity reserves.

When used effectively consulting services can save a charity both time and money. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Like a gift annuity an annuity trust makes fixed payments.

Payout rates for two. In exchange for the charitable contribution donors receive a stream of regular. Visit The Official Edward Jones Site.

Give Gain With CMC. We currently administer over 150 charitable remainder trusts and 600 charitable gift annuity contracts. Charitable Solutions LLC is a planned giving risk management consulting firm.

A Charitable Gift annuity is a contractual agreement that supports BGEA provides a fixed stream of payments to you andor a loved one while offering tax benefits. A gift annuity the simplest life-income agreement is a contract between Cornell and a donor that is established with a gift of 10000 or more. In exchange for a gift of assets ie cash stock bonds real estate etc the.

Do Your Investments Align with Your Goals. Meridian St Suite 700 PO. Charitable Gift Annuity We offer comprehensive affordable.

Charitable gift annuity administration Wednesday May 18 2022 Edit. Ad Earn Lifetime Income Tax Savings. The administration of a charitable gift annuity is not a topic that gets a lot of publicity but it is very important.

Offering constructive expert administration services to assist you and your donors in managing your philanthropic endeavors. Established in 1995 Charitable Trust Administration Company. It is key to understand the stages of the administration of.

Please see the chart that follows for the current rates. After the death of. The charitable deduction would be the excess of the funding amount of the CGA over the present value of the annuity the value to the annuitant.

Ad Earn Lifetime Income Tax Savings. New Look At Your Financial Strategy. The administration of a charitable gift annuity is not a topic that gets a lot of publicity but it is very important.

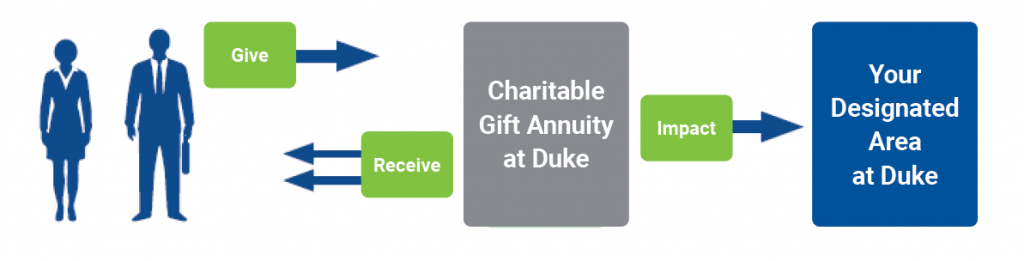

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. Duke University serves as trustee for about 145 charitable remainder trusts with a combined market value of about 52 million. However the tax treatment of an annuity trust.

There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees. We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity. Duke also issues charitable remainder annuity trusts with gifts of 100000 or more.

For the testamentary CGA. The base WatersEdge administration fee is 105. PG Calc makes sure every annuitant receives a check or direct deposit on time and prepares and.

A charitable gift annuity CGA is a contract under which a 501 c 3 qualified public. Charitable gift annuities allow donors to make tax deductible contributions to a charitable organization. The Carter Center works with PG Calc to administer our 270 ish Charitable Gift Annuities.

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Planned Gift Calculator Chicago Symphony Orchestra

Charitable Gift Annuities Giving To Duke

Charitable Remainder Annuity Trust Planned Giving Case Western Reserve University

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Gift Annuities Uses Selling Regulations

City Of Hope Planned Giving Annuity

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Charitable Gift Annuities Give To Ualberta

Use A Quit Claim Deed For Hawaii Timeshare Divorce Trust And Gift Transfers Deedandrecord Com Blog Timeshare Divorce Quites

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

Charitable Gift Annuities Suny Potsdam

I Speak For The Trees For The Trees Have No Tongues The Lorax Dr Seuss The Lorax Clean Air Environment

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Planned Giving The Arbor Day Foundation Arbour Day Arbor Day Foundation Trees To Plant

Change Of Address Checklist Real Estate Seller And Buyer Etsy Change Of Address Checklist Listing Presentation